GEM Engserv Pvt. Ltd is an ISO 9001:2015 certified organization, certified by TUV India in accreditation with National Accreditation Board for Certification Bodies (NABCB).

GEM Engserv Pvt. Ltd is an ISO 9001:2015 certified organization, certified by TUV India in accreditation with National Accreditation Board for Certification Bodies (NABCB).

Micro, small, and medium enterprises, collectively called the MSMEs represent a very important segment of the business landscape in India. While the categorization is based on revenue / investment criteria which is more relevant to the industrial and manufacturing segment, organizations from the service industry also form a part of the MSME ecosystem.

The Small sector with 3.31 lakh and the medium sector with 0.05 lakh estimated MSMEs account for 0.52 % and 0.01 % of total estimated MSMEs. The Micro sector includes 630.5 lakh enterprises, accounting for over 99% of the country’s total 633.9 lakhs MSMEs. The share of manufacturing, trade and service sectors is more or less equal at one third each.

MSMEs are a vital part of the Indian economy, accounting for nearly 30% of the country’s GDP. They also play a critical role in employment generation, with over 100 million people employed in MSMEs across the country. The Government believes that MSMEs are a crucial driver of economic growth and development, and their success is vital to India’s economic prosperity. Therefore, the Government of India, through the department of MSME has taken many steps to promote the growth of MSMEs. Some of the special provisions of the MSME act include the following:

1. Financial support through credit guarantee scheme

2. Exemption regarding submission of Earnest Money in bids floated by the Government departments and PSUs

3. Provision of interest payment to MSME in case payments are delayed beyond the agreed credit period (45 days or as provided in the contract)

4. A department where MSMEs can register their grievances for speedy redressal

While these policy directives are all well intentioned and in the right direction, the implementation is far from satisfactory. There are many PSUs and government departments that still do not exempt MSMEs regarding earnest money deposits. Even after the provisions of the act are pointed out, the tender conditions are not amended.

The benefit of timely payment is also overlooked by many organizations. The second wave of the pandemic, which exposed vulnerabilities of MSMEs like never before, had aggravated their issues such as delayed payments, high informality, and low financial resilience. In June 2020, the Financial Express reported that at least Rs 15 lakh crore stuck in MSME payments annually; dues cleared typically in 3-6 months.

A Fact that further aggravates this is the gap in financing faced by these enterprises. These are usually home grown and family run organisations which run solely on operational margins. There isn’t any room for infusion of capital and cash reserves are also very slim.

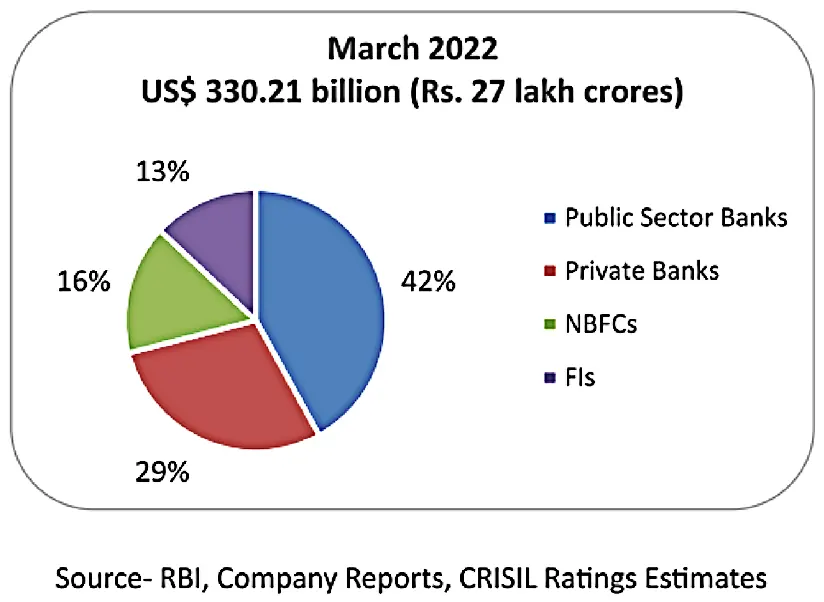

Until recently and even now, MSMEs have faced a huge challenge in acquiring business loans. Banks are hesitant to approve loan requests from MSMEs for a number of reasons and the default response is to summarily reject the request.

One of these reasons for rejection is the high cost of due diligence in comparison to the loan amount. This pushes the interest rates beyond feasibility. Usually however, it doesn’t get to this point. MSME’s loan requests are rejected because we did not have a unified platform to ensure easy availability of information about companies. Loan recovery is seen as a risk because of the delicate balance that these organisations operate in. It seems like the system is setup in a way that MSMEs cannot succeed. There were several unfortunate cases brought to light during the pandemic when organisations had to go to informal and unregulated loan sharks rather than seek support through formal channels. Many of those had to wind up due to the extreme interest costs.

The recent OCEN initiative by the government has been frequently in the media recently, but it’s effectiveness on the ground remains to be seen.

None other than the Hon. Union finance Minister had publicly exhorted the corporate giants to release stuck payments to MSME firms. This places great strain on the cash flow of the MSMEs. The power equation between a large client and a small MSME is so heavily skewed against MSMEs that most do not contemplate lodging formal complaint with the department of MSME.

When approached, the MSME department officials insist on submission of evidence that the invoice was received and accepted by the client. Most organizations receive the invoice but do not issue any acknowledgement of the same, not to mention accepting the content of the invoice. When faced with a complaint of delayed payment, the customer can very easily side step the penal provisions of delayed payment, by converting a case of delayed payment into a dispute of unsatisfactory performance. The department of MSME is not mandated to intervene in a dispute. Despite many improvements in the mechanism of Alternate Dispute Redressal (Arbitration and mediation), only the bravest of the MSMEs can choose to tread the path of raising disputes with their mighty clients!

The behavior of the corporate Goliaths towards the Davids makes one wonder whether MSMEs are indeed an important part of the economic landscape of the country?